Generally, lenders see consumers having sophisticated credit as more gonna build on-day mortgage payments. Consumers having poor credit ratings show an increased risk so you can loan providers, that may affect the pricing they’re offered.

Individuals that shell out a lot of an effective house’s price initial try popular with loan providers. For many who use shorter, you’ll have less to invest straight back, that can affect the loan’s rate of interest and you will payment.

Loan Label

Loan providers generally speaking bring mortgages that have fifteen-, 20-, otherwise 30-year installment terminology. With a lengthier loan identity, you’ll likely shell out a great deal more attract throughout the years, but with all the way down monthly installments. Which have quicker loan terms, you’ll shell out reduced desire overall, but i have to pay with a top payment per month.

Loan Type

Rates may vary greatly with respect to the style of financing you choose. There are antique, FHA, USDA, and you may Va funds. For every single loan type of provides the advantages and disadvantages, thus you will need to favor that loan type that best suits your financial needs.

Interest Type

Borrowers can decide a predetermined-rate mortgage otherwise variable-rates home loan. Those two loan designs can affect your own interest rate and payment.

Fixed-rates Home loan

Home loans which use a-flat interest regarding the lifetime of loan fall into the fresh new repaired-price mortgage classification. This is going to make monthly house payments an easy task to determine, as they will always be a comparable number. It does not matter what are you doing from the housing industry, you will end up shielded from abrupt spikes.

Adjustable-speed Home loan

Lenders supply borrowers mortgage brokers having rates that may changes in the financing name. The new variable-speed home loan has a fixed basic rate that stays constant having a set amount of time. After that initially repaired several months, interest rates alter predicated on economic field standards otherwise exclusively with the the fresh regards to the loan.

What is felt an effective mortgage price?

A home loan rate can look some other for everybody according to its economic character, bank, financing type of, financing title, or other variables.

Mortgage cost alter frequently, perhaps even hourly. Since there is no lay definition of an excellent home loan speed, the reduced the interest rate, the newest reduced you’ll have to buy your home throughout the identity of mortgage.

What is important for borrowers to buy up to, because costs may vary such it is impractical to know if they are getting much rather than researching their choices.

Why you need to Compare Home loan Cost

Individuals is determine if these are typically obtaining cheapest price of the researching mortgage rates regarding numerous lenders. Lenders offers financing rates immediately following a debtor submits a payday loans Powell home loan app.

Doing your research to acquire a competitive mortgage rate might help consumers spend less, end up being positive about the home-to purchase techniques, and you will gain a great deal more understanding of home loan-associated items, depending on the Consumer Economic Protection Bureau (CFPB).

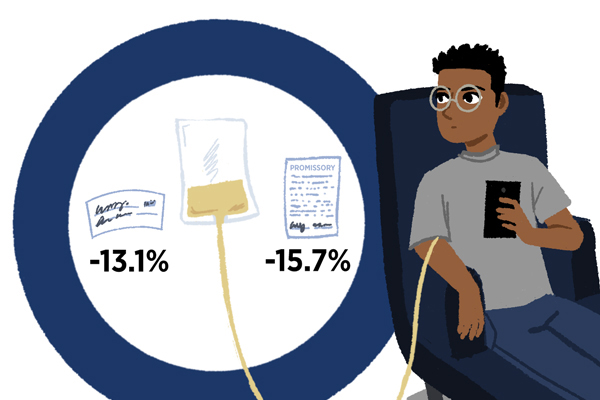

Mortgage speed shopping is important. Rates can differ significantly anywhere between lenders. Interest rates can also be fluctuate by more than half of a single percent to possess individuals with the same economic pages trying to be eligible for comparable financing, based on a great CFPB Workplace out of Browse Working Paper Collection.

Contrasting Mortgage Rates

Zero a couple of financial quotes are the same. Consult mortgage estimates out of all of the lenders you’re thinking about to help you know most of the costs that include capital. Mortgage rates was an official file which can fall apart all of the the costs of the financing.

- The loan amount

- Month-to-month dominating and you can notice percentage

- Total month-to-month can cost you, that’ll range from the overall to have expenditures eg:

- Principal: How much money lent to find the property.

- Interest: The price of borrowing from the bank those funds, often conveyed given that Yearly Percent Rate (APR).