From setup to maintenance to reporting, Yardi Breeze is very user friendly and simple to work with. We will work with you to customize a solution stack that fits your unique business. We also offer customizable solutions like mobile apps and websites for your properties. Our continued innovation wouldn’t be possible without feedback from our clients.

- Allow residents to pay rent, submit maintenance requests, renew leases and more through a secure resident portal or mobile app that integrates seamlessly with Yardi Breeze.

- By far, the biggest improvement that we have now is rent collection.

- Save time and money with all-in-one marketing, leasing, management and accounting software that makes work a breeze.

- That’s a lot for a small company, and it means we’re able to do more deals on the development side.

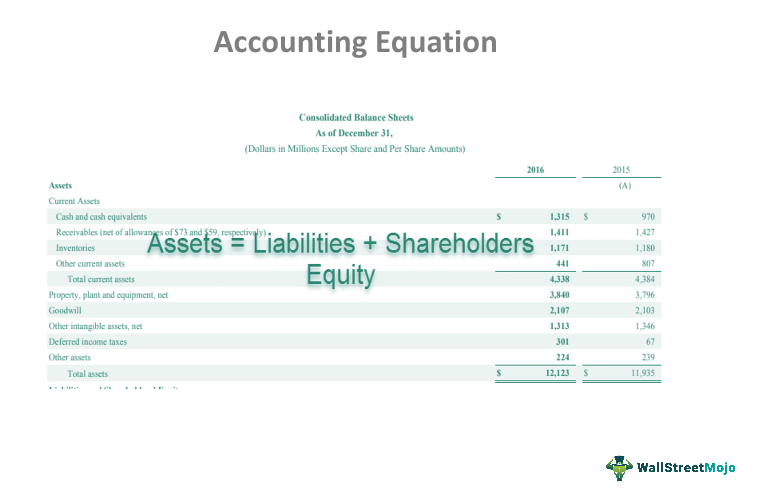

- Be confident that your numbers will always add up with our industry standard, built-in payables, receivables and general ledger functions.

- Yardi Breeze’s intuitive design and modern, user-friendly interface make it easy to complete tasks from anywhere.

The result is a simplified IT footprint and lower total cost of ownership. Save time and money with an all-in-one tenant services, leasing, management and accounting software that makes work a breeze. SANTA BARBARA, Calif., Feb. 20, 2018 — Yardi announced today the launch of Yardi® Breeze, its refreshingly simple software platform built for property owners and operators with portfolios of 1,000 units or less. You can work more efficiently and make informed decisions that create value for your real estate assets. Your property management software should meet five requirements before you decide to stick with it for the long haul.

Breeze Premier

Rest easy knowing your reports are accurate with Yardi’s trusted, built-in accounting system to track your revenue and expenses. And since Breeze is in the cloud, you can work from anywhere and get fantastic support when you need it. Real estate management software is technology that makes asset and property management easier. It helps landlords, investors, leasing agents, maintenance technicians and other real estate professionals track and execute projects and data more efficiently. It also makes renting easier for tenants because it allows them to make payments, sign leases, request support and otherwise manage their accounts online. Our real estate management software includes integrated solutions for accounting, marketing and lease execution, market intelligence, energy management, end-to-end procurement, business intelligence and much more.

Lower software costs and boost your bottom line

Contact one tech support team for all your needs, simplifying the process and finding the right answers faster. Save time and money with all-in-one marketing, leasing, management and accounting software that makes work a breeze. Start by deciding what you need from your property management software. Be confident that your numbers will always add up with our industry standard built in payables, receivables and general ledger functions.

Owner Tools

Accept applications and execute leases completely online with RentCafe.

Electronic billing significantly cuts the cost of collecting and processing rents. Our award-winning energy management systems reduce HVAC costs and ensure regulatory compliance without reducing comfort. By connecting business intelligence at the investment, operations and financial levels, our platforms drive value for funds holding real estate assets. You should reassess your property management software every few years and see what’s new on the market.

Allow tenants to pay rent, submit maintenance requests, renew leases and more through a secure tenant portal or mobile app that integrates seamlessly with Yardi Breeze. The best property management software maximizes efficiency, convenience and ROI for property managers, occupants and investors. Yardi software produces these outcomes by automating business processes, consolidating data and enabling execution of all operations from a single platform. Whatever your reasons for researching property management software, we’re here to help with a guide that includes everything you need to make a smart decision a little more quickly.

That’s a lot for a small company, and it means we’re able to do more deals on the development side. By far, the biggest improvement that we have now is rent collection. We are officially paperless, and all payments go through RentCafe. Follow us on our social media channels for all what happens to assets if the company pays for notes payable the latest industry updates and information. Eliminate paperwork and reduce costs with an online invoice approval workflow.